The Simple Monthly Budget That Everyone Is Trying Right Now

Many people know just how important it is to have a simple monthly budget. The problem is that many people struggle to stick to it. This is because they find it difficult to keep things from becoming much more complex than they really need to be.

This is why we want to introduce you to a super simple monthly budget. One that will take barely any effort to follow. We will also cover how Delaware title loans can help cover expenses that are too big for your budget.

The Importance Of A Simple Monthly Budget

As we said, budgets can be difficult to follow. This is because a traditional budget will require you to record every single expense. If you miss recording a few, even if it is just a few dollars here and there, then your budget won't work.

The simple monthly budget that we are going to discuss will break your income down into three parts. It is going to be a whole lot easier for you to track. This will make budgeting less confusing. Let us explain.

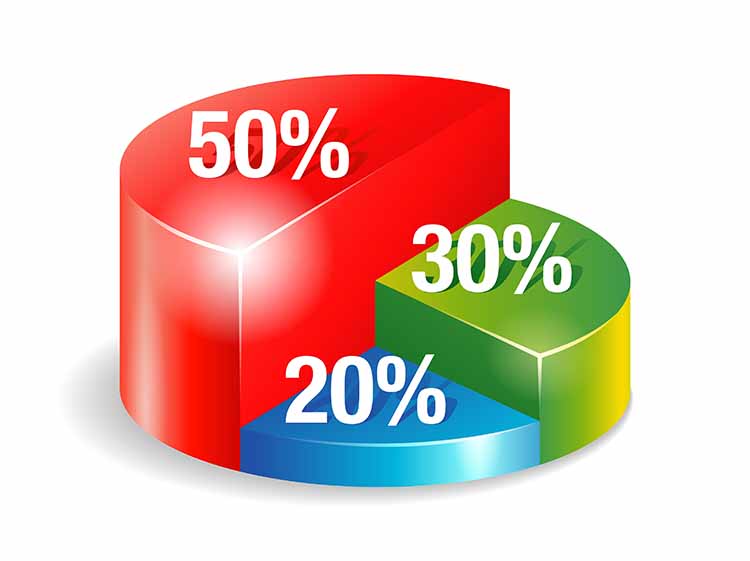

The 50/30/20 Budgeting Rule

The budget that everybody seems to be following right now is the 50/30/20 simple monthly budget. This involves splitting your income into three parts:

- 50% for your necessities.

- 30% for your wants.

- 20% for your savings.

Some people may need to tinker with this formula ever so slightly e.g. if you are very behind on your bills, then you will want to reduce your 'wants' budget and allocate it to savings. However, most people are fine with the 50/30/20 split.

If you split your money up, you will know what cash you have allocated for what. You don't have to think about whether you can afford that cup of coffee. If you have money left in your 'wants' budget, then you can pick up that coffee.

Let us go through the sorts of things you will cover with each percentage of your simple monthly budget.

The 50 (Necessities)

The bulk of your monthly income will be dedicated to necessities. This includes:

- Rent or mortgage.

- Food.

- Travel to and from work.

- Certain bills, such as electricity and water.

- Clothing (when it is necessary. Not purchases from major clothing brands,)

These are the things that you absolutely cannot do without. The things that you need to live and survive.

You can budget your necessities how you want. For us, we set aside the cash for our rent first. We then factor in how much travel to and from work will cost each month. Anything leftover will cover bills and food.

If you don't think that you have enough cash for food, then you may need to adjust the following percentages slightly.

The 30 (Your Wants)

This 30% will be dedicated to your wants. These are the things that you want in life, but you can live without. This could include:

- Your entertainment budget.

- Expensive clothing.

- Video games.

Some people's budgets can be pretty tight. This means that you may need to reduce your 'wants' budget a little bit. Well, at least for a short while. If you learn how to budget properly, it won't be long before you can dedicate 30% of your income to the more luxury items.

The 20 (Remaining Bills And Savings)

The 20% portion of your simple monthly budget will be dedicated to any remaining bills and savings. This will include:

- Cellphone bill.

- Internet bill.

- Credit card bills.

Anything that you have leftover once you have paid off your bills can be put into a savings account.

You can adjust this 20% a little bit if you are looking to get your finances back on track e.g. you have a ton of outstanding bills that you need to catch up on. We would never recommend that you go below 20%, though. This is a great way to build up your savings.

Covering Expenses Outside The Budget

You could put together the most perfect simple monthly budget. However, there may be times when no matter how well you budget, you do not have enough cash saved to cover emergency expenses. This can include vehicle repairs, medical expenses, and emergency appliance replacement. In these situations, car title loans in Delaware could be an option worth considering.

Delaware Title Loans, Inc. is a provider of title loans in the state of Delaware. With us, you can borrow between $300 and $15,000. The amount that you can borrow will depend on the value of your vehicle.

What Is The Process For A Title Loan?

We at Delaware Title Loans, Inc. have ensured that the process of a title loan is as fast and as efficient as possible. Our process is as follows:

- Fill in our short inquiry form on Delaware Title Loans, Inc.

- Within a few minutes, one of our agents will get in touch with you. They will help you with answers to all your questions and will discuss the qualifying requirements for a title loan through Delaware Title Loans, Inc.

- You can go to our nearest location or have a loan agent come to you. You will need to have your government-issued ID, the lien-free title, and your vehicle.

- One of our agents will give your vehicle a quick inspection to determine how much we can lend you.

- If you are approved for a loan, you can sign a few documents to finish the process. The money could be in your bank account on the same day or the following banking day!

Inquire About Title Loans Today

Budgeting is very essential to get anywhere in life. But what do you do when you have expenses that you can't quite cover with your simple monthly budget? A title loan from Delaware Title Loans, Inc. could be an option worth considering. Fill in our inquiry form today to find out if you qualify.

For more about budgeting your paycheck, read our other budgeting tips and tricks articles.

Note: The content provided in this article is only for informational purposes, and you should contact your financial advisor about your specific financial situation.