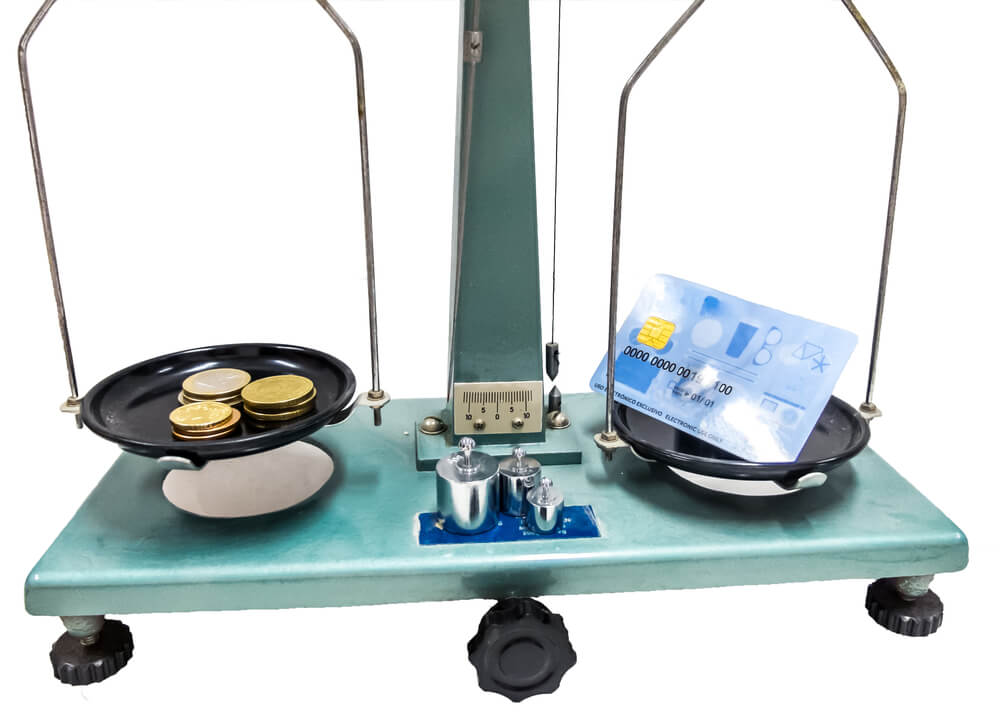

Cash vs Credit Card vs Loan: How To Get And Spend Money

Cash or credit card? Credit card or loan? These questions circulate in the consumer world often.

At the end of the day, they all do the same job — fund something. However, the consequences – both positive and negative – vary wildly between all three.

Having said that, there are times when one is better than the other. Like a credit card can give you more convenience and speed, while cash can keep you on track with your budget. And even an online title loan can be best for quick cash in big emergencies.

The question remains, how do you identify when to use each one? Here are a few tips to determine when a credit card, cash, or loan is best to use.

When To Use Credit Cards

Credit cards are incredibly convenient and can come with a wide array of benefits that you simply can't get with cash. Because of this, they are a popular option, although people tend to overuse them at times.

But, if used responsibly, they can help you in many ways

For Travel Security

If you travel frequently, you are more available to fraud due to language barriers and unfamiliar situations. However, when you use a credit card, you can shut it down and replace it over the phone. With cash, all hope is lost when it's stolen.

To Get Benefits And Earn Rewards

Depending on the brand of your credit card, you'll receive various rewards. For instance, if you have an airline-specific credit card, using it might land you with free luggage limits or seat upgrades.

Furthermore, credit cards tend to come with reward programs. Whether it is cashback on all purchases or discounts in certain stores, the programs are incredibly attractive.

To Get Extra Warranty And Protection On Your Purchase

If you're buying something valuable or a major purchase, a credit card is useful. Why? Because providers usually offer an extended warranty period and an extra security blanket if something goes wrong.

To Buy Goods You Can Afford

Credit cards are more secure than cash, so they are less risky to carry around with you. With that in mind, using a credit card to buy groceries is fine — as long as you can afford to pay the bill back in full.

When to Use Cash

Now, just like there are times when using a credit card is best, there are also times where cash is the way to go. Of course, one downfall to cash is you lose the convenience of just swiping your credit card at the register. But that is just a minor inconvenience.

Aside from setting a spending limit for yourself, using cash can help in a lot of other ways as well.

When Transaction Fees Are Present

For those of you who were looking to take advantage of a credit card reward program by using it to pay regular monthly outgoings, it isn’t recommended.

The likelihood is that you'll be stuck with a transaction fee to pay each time, making your total bill far more expensive than necessary. Instead, just use cash to avoid those pesky transaction fees and pay just what is absolutely necessary.

When You're Trying To Acquire A Mortgage

Underwriters do not want to see any change in your credit habits while they are processing your mortgage application. Typically it takes between 4 and 6 weeks to process and any changes only prolong and sometimes stop the procedure. This is where using cash can help you avoid making any changes while your mortgage is being processed.

To Buy Expensive Items

Using cash to buy items out of your normal budget is great — it means you have had to save for them. Using a credit card for something you can't afford is a huge no. You'll end up in a never-ending debt cycle that will not benefit your future.

When To Choose Loans Over Credit Cards

Generally speaking, loans are always best if you have to borrow a big lump sum of money and you're able to repay it regularly. You can usually borrow far more with a loan than a credit card – making it perfect for serious medical bills and home renovations.

Plus, if you easily overspend and re-borrow, loans will instill discipline. Whereas a credit card will constantly allow you to borrow more. And if you happen to get a loan like a title loan, these are even better for emergencies.

What Is A Title Loan?

There may come a time when you need money fast. Whether you have unexpected medical bills to pay, urgent home renovations to fund, or necessary travel to pay for, title loans can help.

Title loans are short-term loans that allow you to borrow a lump sum when you put up your vehicle’s title as collateral. The amount you can qualify for – anything between $300-$15,000 – is based on the value of your car, truck, or motorcycle. And the best part is you can apply for this loan regardless of how your credit looks.

How To Acquire A Title Loan In Delaware

Getting a title loan from Delaware is simple. It only requires a few documents and a trip to the nearest Delaware Title Loans location. Just follow this guide to understand how to get a title loan today:

- Head to our website and fill out the form on the website. We ask for basic information so it shouldn't take longer than 5 minutes.

- Wait for a loan specialist from your closest Delaware storefront to call you to go over the process.

- During the conversation, they'll tell you about the rest of the process. Now is also a good time to ask any questions.

- Bring your driver’s license or government-issued ID card, lien-free vehicle title, and your vehicle to your closest Delaware storefront.

- Wait while one of our loan experts evaluates your vehicle to determine how much you could borrow. They will also determine if you qualify for approval.

- If you qualify for the loan, complete the rest of the paperwork with the loan specialist.

- Once everything is finished, receive your money on the same day!

If you have any concerns before starting the process, just give us a call. One of our loan experts will put your mind at ease.

It is important you know exactly how credit cards, cash, and loans – like title loans – are different and which one works for which situation. Whether you are looking for convenience, sticking to your budget, or quick cash, check out the differences to make the smart choice.

Read more of our articles about managing credit and debt.

Note: The content provided in this article is only for informational purposes, and you should contact your financial advisor about your specific financial situation.